US President Donald Trump delivers a keynote speech at the World Economic Forum (WEF) held in Davos.

US President Trump speech key takeaways

“You all follow us down and you’ll follow us up.”

“Certain places in Europe not recognizable any more.”

“Europe is not heading in the right direction.”

“Green energy focus, mass migration has hurt Europe.”

“We’re very much into world of nuclear energy.”

“European energy has reached catastrophic low levels.”

“Want Europe, UK to do great.”

“China makes wind farms but uses coal, doing just fine.”

“US cares greatly about the people of Europe.”

“We believe deeply in the bonds we share with Europe as a civilization.”

“Economic growth, trade, immigration are central concerns to a strong and united West.”

“These are matters of national security.”

“Tremendous respect for Greenland, Denmark.”

“No nation can secure Greenland other than US.”

“US set up bases on Greenland for Denmark, we fought for Denmark.”

“US saved Greenland, gave it back to Denmark after World War II.”

“Denmark ungrateful now.”

“Greenland is sitting undefended in a key strategic location.”

“Seeking immediate negotiations to discuss acquisition of Greenland.”

“This would not be threat to NATO, would enhance the alliance’s security.”

“We give so much to NATO and get so little in return.”

“I won’t use force.”

“US has gotten nothing from NATO.””

“All we are asking for is to get Greenland, right, title and ownership.”

“Cannot defend Greenland on a lease.”

“Will build golden dome, it will defend Canada.”

“Canada’s Carney wasn’t so grateful to us in davos speech”

This section below was published as a preview of US President Donald Trump’s speech at the World Economic Forum (WEF) at 10:00 GMT.

United States (US) President Donald Trump is scheduled to deliver a keynote speech at the World Economic Forum (WEF) held in Davos at 13:30 GMT. The speech is expected to start on time despite Trump’s trip to Davos being delayed as Air Force One was forced to turn around due to a “minor electrical issue”.

Trump’s speech will be closely watched by financial market participants as it will indicate what other measures the White House has at its disposal to intensify pressure on European Union (EU) members, who oppose Washington’s plans to acquire Greenland.

Greenland’s Prime Minister (PM) Jens-Frederik Nielsen has clarified in a joint statement with Denmark’s Mette Frederiksen that his economy prefers to remain a semi-autonomous Danish territory.

So far, President Trump has imposed 10% tariffs on several EU members: France, Germany, Denmark, Norway, Sweden, the Netherlands and Finland, and the United Kingdom (UK), which will become effective from February 1, for opposing US control of Greenland, and warned that additional duties could rise to 25% from the summer if no deal is done.

In response, EU members have warned of proportionate countermeasures against Trump’s tariff threats, calling them “blackmail”. French President Emmanuel Macron has stressed the need to deploy an anti-coercion tool, nicknamed a “trade bazooka”, in retaliation to Trump’s tariff threats. In the WEF on Tuesday, Macron said that the world is reaching a time of “instability and imbalances,” and the answer is “more cooperation,” not a system that accepts “the law of the strongest”, The New York Times (YT) reported.

Officials across the globe have also criticized Washington’s additional tariff threats. Canadian Prime Minister Mark Carney affirmed support for EU members, citing “Middle powers must act together because if we’re not at the table, we’re on the menu”, BBC reported.

How could Trump’s speech affect EUR/USD?

Signs from US President Trump’s comments signaling that Washington intends to acquire Greenland, even forcefully, and will keep the option of military action on the table, would be unfavorable for the US Dollar. Such a scenario could escalate tensions between the world’s largest economies, potentially leading to a trade war. On the contrary, Trump’s gentle comments on the Greenland crisis would ease geopolitical tensions, boosting hopes of improvement in the appeal of risky assets, the US Dollar, and US assets.

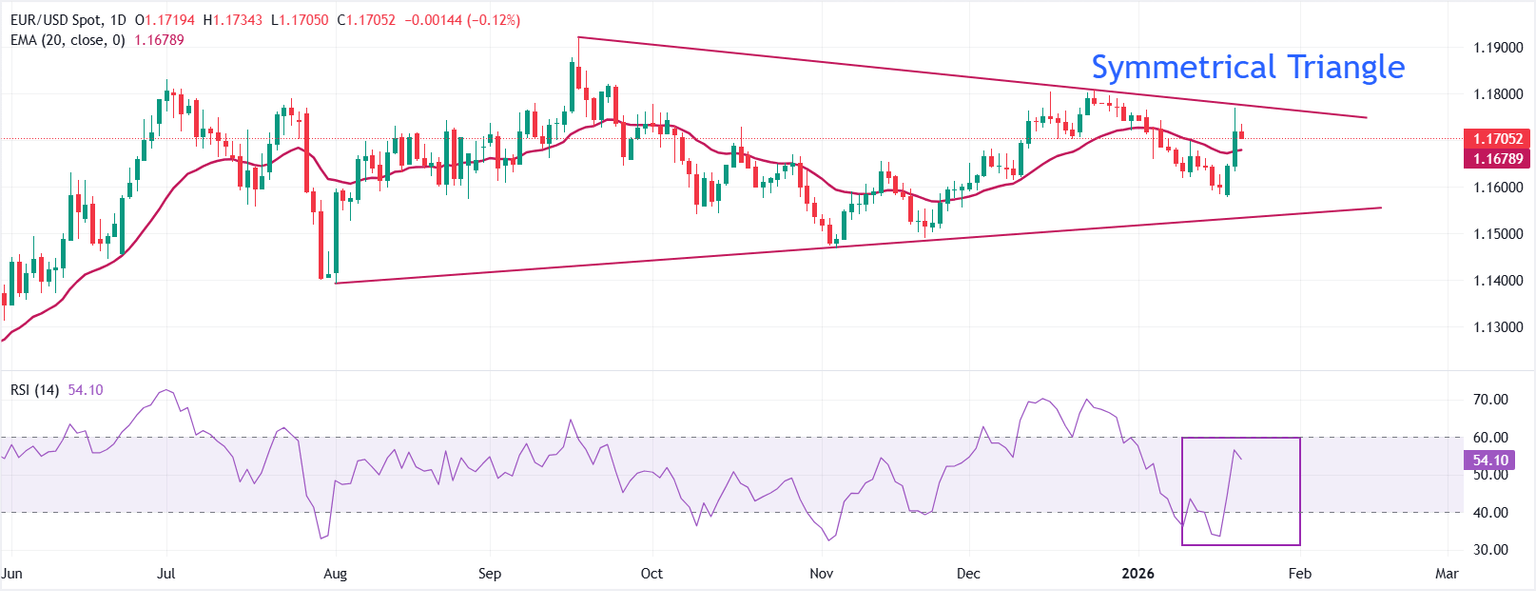

EUR/USD trades lower at around 1.1700 as of writing. The 20-day Exponential Moving Average (EMA) at 1.1679 edges higher beneath spot, supporting the short-term bias. A pullback would be expected to find initial demand around this dynamic level.

The 14-day Relative Strength Index (RSI) at 54 is neutral-to-firm, consistent with a measured upside impulse. A descending trend line from 1.1921 caps advances, with resistance at 1.1775. A daily close through this barrier could extend gains.

The rising trend line from 1.1393 underpins the broader structure, offering support near 1.1533. Failure to clear 1.1775 would keep rallies capped and leave scope for consolidation above the trend base. A sustained push beyond the descending barrier would shift focus higher, whereas holding below it would preserve a rangebound tone.